Chapter 8 Beyond Fintech – Applications for The Modern World

Learning Objectives

Upon completion of this chapter, students should be able to:

- Define the term IoT and IIoT and differentiate between IoT and the conventional Internet

- Discuss composition of IoT

- Understand the application of smart technologies in IoT

- Articulate technology similarities between IoT and Fintech

- Define Digital Twins and their integration into Fintech

Introduction to the Internet of Things

There is another technological revolution happening alongside Fintech. It is much bigger than Fintech, financially much more impacting and possibly by volume, is much larger than the conventional Internet. So, lets pause for a second and ask what is the single central object that defines the current “conventional” Internet? It is You. Everything in the current Internet is about you, me, and billions of other people. It is this massive Internet technology that provides human-to-human connection. Whether be it through social media, companies’ websites (companies after all, are people in companies offering their products or services for us -people again, to use, consume and dispose of.

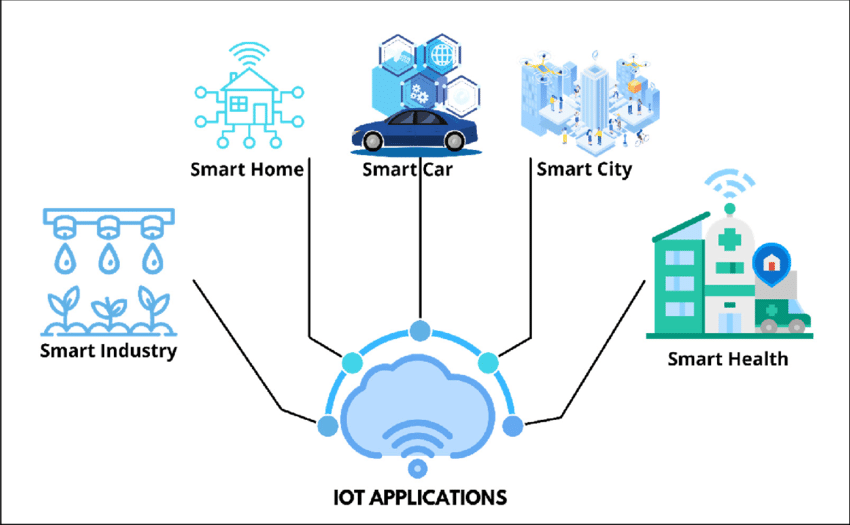

There is out there a new type of an Internet known as the Internet-of-Things (IoT). It uses the current internet’s backbone for connection. It does not connect people. It connects things, inanimate objects such as devices, industrial machines, trees and crops, weather and crops, and markets and crops. It also connects cities with energy sources, cities with autonomous driving vehicles, and cities with other cities. Its focus is to exchange information in a thing-to-thing manner, and in Real-Time. Here are some examples:

Imagine for a second that you are in your 30’s, with 2 kids. You live in the Midwest, and you decided to vacation in Florida visiting your retired parents. You have completed the visit and now you are ready to take the kids to Disney. You hit I-4, a 4-lane highway. You are cruising in the far-left lane. You are distracted by the kids constantly yelling “are we there yet…”, and as you approach Disney, I-4 turns into this massive 8-lane highway, and then you realize you only have 1 mile to the exit. To add to your frustration, no other vehicles yield to your lane change signaling, as if all other drivers have lost their courtesy. And you miss your exist!

Now imagine in a world where your car is a smart car just like everyone else’s nearing that Disney exit. Your car begins to “negotiate” via its smart contracts system with other cars, traffic signals and even the exit ramp. Cars will, through a digital contract (the negotiations component) that mimics human common courtesy, and road rules, to yield for you, and you will not miss your exist. Imagine the day when, in a smart city, you’ll never have to stop at a traffic light, because they will not exist, or face the risk of running over a pedestrian (U.S. Department of Transportation, National Highway Traffic Safety Administration. n.d.), because they will have on them smart wearable outfits that can detect your car. Running over pedestrians will be a thing of the past and finally imagine your smart home with a smart refrigerator sending you a message saying the baby is out of formula. We are not imagining as this is real and is happening.

IoT Basics

As we mentioned earlier, IoT is fundamentally two or more things (machines, buildings, cars, etc.) communicating with each other exchanging data and acting upon the exchanged data. All IoT systems begin with a network of sensors, installed in an environment such as a factory, hospital, office building or homes, connected to a computational facility that is fed data from the sensors. The computational facility executes tasks that identify the present, real-time conditions of the environment.

The key Components in an IoT system

IoT systems are composed of 5 key and essential parts:

- Sensors – Are devices that measure the environment. There are hundreds of different types of sensors made for every natural condition such as heat, smoke, fumes, pressure, temperature, humidity, wet, dry, acidic, etc. Cameras for example are used as Vision sensors. Microphones are used as sound sensors, Anemometers are used to measure wind speed and direction, Level meters are used to measure how high or low the surface of a liquid is. Key sensor types that have been applied to fintech include:

- Accelerometers – Are the most common type of a sensor. They are embedded in cellphones, cars, and wearable devices such as Apple Watch that allow for detection of physical movement. Their applications in Fintech support Insurtech companies to allow for monitoring a car’s speed, time of day, and coupled with other sensors such as geolocation to determine location. This information can be analyzed to determine a customer’s driving habits such as how often they accelerate, slow down, emergency stops, etc. They are currently used to determine how much insurance premiums to charge (i.e., Insuretech). Accelerometers used in smart wearables also found their way into healtech by measuring how much we walk, run, jog, our heart rate, etc.

- Gyroscope sensors – are used to detect orientation of a smart phone (landscape vs. portrait mode positions). Gyroscopes in headsets are used in the gaming industry for virtual reality experience and in museums offering virtual tours of world’s famous museum sites without ever having to leave your couch. Fintech in this case is integrated to allow gamers, or museum visitors to purchase in-game tokens or memorabilia from the museum’s gift shop.

- Magnetometers – Are magnetic sensors that can detect compass headings. They are used in games or in shopping applications to determine things such as “checkout lane #9 has no lines”.

- Barometers, Thermometers, and Hydrometers are all types of sensors that measure natural conditions such as elevation, temperature, and humidity levels.

- Bio sensors that measure conditions such as the presence of microorganisms and biological conditions such as bacteria, fungus, viruses, toxins, etc.

- Computational Facility – Is a processor-based device (a computer) that converts sensor inputs into Data that computers can read. Computational facilities execute software programs (Apps) that allow for things such as looking up items from inventory, pricing items, applying taxes, calculating totals, accepting payments and recording the transaction and issuing paper or digital receipts.

- Actuators – Are devices to can be commanded to move (such Open a Valve, move a robotic arm so many inches forward, turn power on/off, etc.)

- Human Machine Interface (HMI)– A small, dedicated computer device that can accept commands directly made by humans (for example, to interrupt or change a pre-programmed sequence of events, such as “stop the conveyer belt” on a checkout line)

- The Cloud – A remote data center that performs the Big Data Analytics and possibly house the AI module that can predict certain outcomes.

Use Case 1 The Application and Role of IoT Sensors in Smart Farming

Let’s explore some farming challenges for a corn farmer located in Kansas and how IoT is transforming traditional farming into smart farming. Let’s begin by studying a farmers set of challenges. This farmer produces different varieties of cereal crops on a very large scale. The key challenge for the farmer is to remain competitive and profitable while simultaneously reducing costs. For his crops, he must determine what to grow, when to grow, and how much to grow. His experience-based decisions are no longer supportive in a highly competitive market. He needs to base his decisions on real-time data instead. The data must reveal several factors:

- Demand Knowledge (Forecasting Demand). i.e., how much should the farmer produce next season? Will the customers continue buying the items made with this type of crop? What is the demand pattern? (Rising, Flat, Falling)? Additionally, the farmer must be able to evaluate and answer questions such as: What are the current exchange trading points on key commodity exchanges such as the Chicago Board of Trade (CBOT), the Kansas City Board of Trade (KCBT) and the Minneapolis Grain Exchange (MGEX)?

- Weather Knowledge: Will the farmer in this region experience draughts? floods, snow and ice, winds, or any other natural events that may induce a bumper crop or a failed one.

- Crop Field Management Knowledge: When to plow? When to plant? When to irrigate? How to fight plant diseases? and when to harvest?

- Farm Production Management Knowledge: Which equipment to use? What (Availability of Manual Vs. Automated) labor to use? Which transportation methods to use? Which refrigeration methods to use? Which markets to sell to? Which global shipping companies to use? and which regulations to apply? Etc.

IoT Integration into Smart Farming

Dissecting the smart farming Use Case, we find possible implementation of various enabling technologies that can come to the rescue and help that farmer be more productive, suggest using more efficient & effective farming methods and produce better quality products delivered to satisfied customers. This modern farmer should use Big Data sourced from hundreds (or even thousands) of inexpensive, commercially available sensors connected to a reliable, inexpensive computing facility. An example implementation could include:

- Soil sensor network – That constantly measures precise soil conditions:

- Wet Vs. Dry to determine when and how much to irrigate

- Soil Nutrient Monitoring to determine when to apply the proper amounts of Nitrogen, Phosphorous and Potassium and other natural or synthetic fertilizer chemicals.

- Soil temperature to determine ideal time to plant

- Temperature Sensor Network to measure ambient temperatures to determine effects of excessive heat or excessive cold in predicting crop growth

- Vision Sensors – to automated detection of onset of disease and insect infestation to determine appropriate methods of prevention. Preventative measures today include the use of Drones to identify localized infestation and only apply chemicals to those affected areas. In some cases, farmers are using drones equipped with high energy lasers to target pests, or diseased areas reducing reliance on chemical pesticides and herbicides.

- Sensors to automate field operations – Latest development of Plows and Harvesters technologies use precise GPS signals to plan and execute work routes during the plowing and harvesting operations. Machines are being equipped with additional sensors to identify crops at their peak maturity and smart robotics will pick only the fruits that are ready. Machinery can identify and avoid obstacles in their path and pick and pack fruits with a dexterity matching human eye and hand.

- Shipping, Temperature, Location and Identification sensors – Modern shipping containers use what is known as “cold storage” are being monitored 24×7. Farm products are being monitored while they are in routes to markets. GPS location sensors, temperature sensors, and accelerometers coupled with Radio Frequency Identification (RFID) sensors embedded into shipping containers give precise information as to distance travelled, condition of shipment (for example bruising of tomatoes or bananas), time travelled, and precise arrival times at markets all are available throughout the journey and shared with everyone concerned with the shipment such as Banks, Insurance companies, trucking companies, wholesale traders, trans-continent shipping companies, customs clearing companies, government authorities, and buyers.

How IoT in Fintech impacted the Supply Chain of Farmer-to-Intermediaries-to-consumers?

The 3 key lessons learned from this use case shed light on various outcomes all related to the supply chain in farm production. The impacts are felt in:

-

Personalized Financial Services

– Farmers are no longer blindsided by financial institutions. They are being equipped with exact data that enables financial institutions to underwrite the farmers with exacting loan guarantees. Similarly, insurance premiums are calculated based on exact amounts of risks (failure of a crop, loss of crop during shipments, loss of crop due to disease, loss of crop due to weather, loss of crop due to (fill in the blank_______, etc.) across the entire farming sectors. As Risk, by definition, is a level of uncertainty. The case here is: if it is being measured it is being known.

-

Enhanced Payment Systems:

IoT-enabled devices, embedded in fintech-enabled systems allowed for fast, secure, immutable, and trusted exchange of monies through transactions starting with the farmer – possibly by un-conventional crowdfunding means, and spent by the customer- again by unconventional means- up and down the supply chain.

-

Originality and Fraud Detection –

IoT- enabled devices enhance fraud detection by providing real-time data from the farm’s field to verify if the farm product is truly “organic”, or if the product is accurately described as locally grown.

-

Improved Supply Chain Performance:

IoT devices embedded in supply chains provide accurate and real-time data on inventory and shipments. This transparency enables financial institutions to offer better financing options based on real-time supply chain conditions.

IoT and Industry Application Throughout the Economy

The Internet of Things beyond fintech covers major sectors of the economy. Its current applications include:

The Insurance Industry:

Just as fintech is disrupting the Insurance sector with Insurtech so is IoT. IoT is revolutionizing this sector by enabling risk-based pricing and personalized policy offerings. As an example, connected vehicles are provide driving data for usage-based insurance (UBI). AI-supplemented data with its predictive capabilities can easily score, with a high degree of confidence, the likelihood of getting into a serious auto accident. Equipping commercial vehicle drivers’ cabin with sensors that monitor a driver’s health conditions such as fatigue can force the vehicle to stop assuring driver’s compliance with stated “must rest” policies. High speed communications can add further safety margins to all drivers by warning of adverse conditions ahead such as congestion, smoke, blizzards, snow or heavy rains, all leading to safer driving. For health insurers, body wearable IoT can report on exercise, type of exercise, location of the exercise, and human vital signs again reducing probabilities of adverse health condition prior to their onset. Health-focused IoT devices allow insurers to incentivize healthy behaviors through dynamic premium adjustments. Additionally, IoT-enabled sensors in homes can detect potential hazards, such as water leaks or fire risks, leading to proactive risk mitigation and lower claims.

The Shipping, Warehousing, Transportation and Logistics industries

IoT sensors track shipments in real-time, providing data on location, temperature, and humidity amongst many other measurements. Fintech solutions integrated with IoT data enable better financing options for shipping companies by assessing risk in real-time. For example, blockchain-based smart contracts can automate payments upon successful delivery, improving efficiency and reducing fraud.

In the Warehousing Industry IoT devices monitor inventory levels, optimize space utilization, and track goods movement. Radio Frequency Identification (RFID) is used in stores to monitor products on shelves and in the Warehouse eliminating the manual in-process inventories and Quick Read (QR) codes are being integrated with RFID to provide Product Identity communication. Financial institutions can leverage this data for inventory financing, offering loans against real-time inventory values. Predictive analytics driven by IoT ensures timely replenishment and minimizes operational disruptions, directly influencing financial outcomes.

In the Transportation Industry with smart cars, trucks, planes, or trains connected to fleet management systems provide data for optimization on fuel usage, route planning, vehicle scheduling, operator scheduling, delivery location scheduling, vehicle maintenance scheduling, and regulatory compliance reporting. Fintech applications analyze this data in real-time to offer tailored financing solutions for fleet operators, such as dynamic leasing options. Insurance providers also use IoT data to assess risks and provide pay-as-you-drive policies, ensuring cost-effective operations.

The Healthcare Industry

IoT devices such as wearable health monitors and medical equipment collect data that can be used for health insurance underwriting, dynamic premiums, and fraud prevention. Fintech applications streamline billing, payment processes, and insurance claims, creating a seamless experience for patients and healthcare providers alike.

The Real Estate Industry

IoT-enabled smart buildings and home automation systems provide data on energy usage, security, and maintenance needs. Fintech applications use this data to offer flexible mortgage options, property insurance, and energy efficiency financing, promoting sustainable and cost-effective real estate operations.

The Hospitality Industry:

IoT solutions in hotels, such as connected room systems and occupancy sensors, integrate with Fintech platforms for dynamic pricing, personalized guest experiences, and streamlined payment processes.

The Utility Industry

Traditional as well as renewable energy sectors are being heavily impacted by IoT. Green and renewable sources such as Solar farming, Wind Farming, and Geothermal farming have been with us for many decades and IoT is now being embedded to improve operational efficiencies, reduce carbon footprint, increase output, and solve many of the earlier design flaws. IoT is being retrofitted into power distribution systems creating a nation-wide smart grid that automates power distribution amongst various power companies. Utilities are being deregulated to add additional power capacity through independent power generation using smart, micro-grid technologies. Electric utilities are adding IoT-powered smart meters to give insights into real-time power consumption patterns and to help identify areas in homes that can reduce usage. Water and wastewater companies as well are adding smart meters that communicate with smart home devices, as well as with water company in real-time eliminating the need to visit each home monthly to collect water usage data for accurate billing. Fintech plays a major role in these sectors especially in negotiating power distribution (buying and selling excess power amongst neighboring utilities), customer billing, and in outage minimization and reporting. For water utilities the same concepts apply. Integrating IoT and fintech through smart contracts simplifies water rights, water distribution, production of clean water, and customer billing.

The Manufacturing Industry:

The manufacturing sector is seeing large scale deployments of IoT into the many types of production methods. Robotics, 3D printing, software bots, big data analytics and AI, are being applied across most manufacturing sectors to achieve goals such as expediting design and prototyping, increase operational efficiencies, reduce waste, optimize manufacturing processes, predict and reduce downtime due to machines and equipment failures, improve security and safety and enhance and innovate with new products. New technologies are being introduced to support many of these goals. One key technology, known as Digital Twins has a tremendous promise especially in the manufacturing sector and it directly ties to IoT and fintech.

Digital Twins – A Disruptive Industrial IoT (IIoT) system

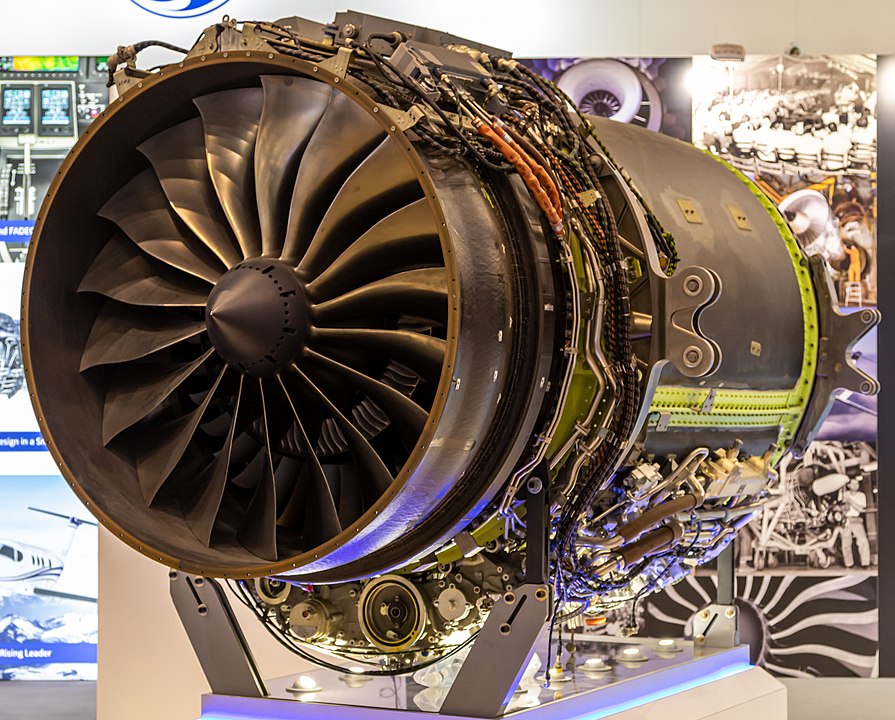

IoT devices, especially smart and wireless sensors attached to machinery gave rise to building what is known as the smart factory where automation processes have taken over many of the tedious and/or hazardous work. Other applications that had their roots in industrial environments have far advanced into other automation fields such as Digital Twins. Digital Twin technology is, in essence, a simulated digital environment that replicates the identical functions of a real machine.

Digital Twins work by creating an exact replica of a product inside the computer using high-definition 3D graphics sometimes presented as holograms. All the real engine components and how they work, are graphically represented in visual 3D models. Their virtual sensors are “wired” and connected just as if they are a real engine. The model usually has a real engine which the hologramlike image is created from. The two engines, the Real and the Virtual sit side-by-side and are to be compared. The real engine sensors have dual outputs. One output is sent to the engine control system controlling the real engine, while the 2nd output is sent to the virtual engine’s control system. Human operators can then exercise, both engines to compare performance. Human operators can then apply various conditions against the simulated model. These scenarios replicate real life, but they are only applied against the virtual engine to observe its behavior. Building real engines to use as test beds, is very costly especially if destructive testing is to be carried out. Hence, to reduce costs, one could build a virtual engine using Digital Twin technology and in the virtual model run tests on scenarios such as how the metal behaves if a fire breaks out inside the engine, or what happens if the engine is operated beyond its engineering tolerances, or other scenarios such as what happens if a bird, or large hail stone, gets ingested into the engine.

These same concepts apply directly into fintech as well. In Fintech, Digital Twins have been implemented in various real-life simulated settings:

- Customer Behavior Modeling – A digital twin of a customer is created for analyzing their financial behavior, transaction history, credit usage, and even non-financial data like social media interactions or geolocation data (where legally permissible). The Digital Twin is used to predict customer needs (e.g., offering loans before the customer need them) or to personalize product recommendations like credit cards or investment portfolios. An example would be to simulate how a customer might react to changes in interest rates or a new financial product, helping tailor marketing strategies.

- Risk Assessment and Management – A digital twin of an organization’s financial portfolio or operational structure helps monitor and predict risks. Organizations are currently testing their financial models under various economic conditions like inflation spikes or market crashes. Digital Twins are also used to evaluate the impact of regulatory changes on profitability and compliance. Insurers, for example, could simulate catastrophic events to see how claim payouts affect reserves.

- Fraud Detection and Prevention – Digital twins of financial systems can mimic real-world transactions in real time to identify irregularities. Organizations can monitor transactions and flag suspicious activities, such as unusual purchase patterns or multiple failed login attempts. Other scenarios can also test for security measures against potential cyber weaknesses and threats. One novel use could be done by payment processors for predicting and blocking fraudulent credit card transactions before they occur.

- Investment Portfolio Management – Digital twins of investment portfolios simulate their behavior under different market conditions. Investment bankers can run “what-if” analysis to test strategies like rebalancing portfolios, adjusting asset allocations, or to predict future performance based on historical data and economic trends. Another example is where hedge funds are using digital twins to simulate high-frequency trading strategies and to fine-tune algorithms for maximum returns.

- Financial Product Development – Digital twins enable rapid testing and optimization of new financial products like loans, insurance policies, or payment plans. The new products are tested in simulated environments before launch to identify and measure market response. Sales departments can test pricing structures, fine-tune pricing, terms, and measure risk exposure to ensure profitability.

- Scenario Testing for Economic Policies – Government Central banks use Digital Twins technology to simulate effects of new economic policies. Central banks can test the impact of interest rate changes, tax reforms, or stimulus packages. Other uses of Digital Twins could include evaluating possible outcomes of extreme scenarios such as recessions or market booms and to evaluate effects on financial markets due to quantitative easing or tightening.

Feedback/Errata