Chapter 7 Introduction to Artificial Intelligence

Key Principles

Where is AI making big a big splash? AI has been transformative across several industries driving innovation, improving efficiency, reducing costs and creating new business opportunities. Examples of industries that have extensively benefited from using AI:

- Finance – AI is heavily used in fraud detection, credit scoring, Robo-advising, market trading and a host of other applications.

- Healthcare – AI is used as an adjunct to diagnostic tools, personalized treatment, and Robotic-assisted surgeries.

- Retail and eCommerce- Used in developing personalized recommendations; Sales & marketing; Inventory Management; Warehousing; and Transportation & Shipping

- Manufacturing – Digital Twins, Smart manufacturing; Autonomous Machinery and Robotics

- Transportation and Logistics – Route Optimization; Autonomous driving; and demand forecasting and management.

- Agriculture (Smart Ag) – Precision farming; Crop monitoring; harvest prediction and weather prediction.

- Energy Sector – Smart Grid and Renewable energy sourcing.

- Education – Personalized learning, Administrative Automation; virtual tutoring

- Legal – Intelligent case search and court preparations, contracts analysis and management.

Learning Objectives

Upon completion of this chapter, students should be able to:

- Define the nature of intelligence and how humans learn

- Define Intelligent Systems (Artificial Intelligence)

- Define key characteristics, and components of Expert Systems

- Explain how Artificial Neural Networks work

- Explain how Machine Learning works

- Explain how IIoT incorporates AI

- Demonstrate practicality of use of AI across many industries

- Clearly give example uses of Natural Language Processing models using ChatGPT

- Explain the different types of Software and Hardware Intelligent Robotics

A Historical Evolutionary Perspective on AI

2300 years ago, the famous Greek philosopher, Aristotle made the first reference to something close to the idea of intelligence in his famous work Prior Analytics & The Theory of Syllogistic, which is “reason”. Reason, according to Aristotle, was about humans’ ability to reign in their passions, i.e., our ability to resist the urge of our instincts (University of Chicago Press, 2020).

Humans have attempted to replicate human functions for many centuries, such as Leonardo Davinci’s Flying Machines and Blaise Pascal’s first calculating machine.

Not until the early, to mid-20th century with the development of electricity did innovations such as Neural Networks, the first electrically driven calculating machine (1947), and the first use of the term “Artificial Intelligence” (1956) came to being (Dartmouth College, n.d.).

Artificial Intelligence

Humans are great thinkers. Our brains have a tremendous capacity of thought. Computers on the other hand beat humans when it comes to mathematical calculations. Current capability of supercomputers such as the Cray EX built by Hewlett-Packard™ registers over 550 petaflops (that’s 550,000,000,000,000,000 multiplications per second). Even with such speed, it still takes the CrayEX about a second to decide on a move in chess. Artificial Intelligence speed is improving at a very fast pace. Scientists estimates that today’s AI would achieve full human-like thought capabilities by mid-21st. century. Speed however is not the ultimate target in the foreseeable future. General AI is the target. The scope of Intelligence in AI is divided into 2 broad categories:

Narrow AI

This is the type of AI we have today and may achieve its full potential by mid-century. Narrow AI is designed to learn to perform specific tasks that will achieve specific goals. These tasks can be quite complex, but they are limited to a narrow scope. Narrow AI “behavior” is highly predictable because it must learn and operate in its specific environment in order to reach a specified conclusion. I.e., it must be trained just like us, humans. Narrow AI, example applications include:

Image recognition (e.g., identifying objects in real life or pictures of real life using distinguishing and differentiating detail (e.g., tree vs. rose, horse vs. sheep, cube vs. triangle, school bus vs. commuter bus, etc.)

Natural language processing (e.g., translating across many natural languages, and manipulating text, speech, images, music, art, even poetry by regeneration (AKA regenerative learning) to produce human-like output.

Recommendation systems (e.g., suggesting movies on Netflix, presenting products you most likely will buy, and even predicting future outcomes, with a high degree of accuracy, based on learned experiences, etc.) Game-playing AIs (e.g., Chess, Go, and immersive universes known as Multiverse, Virtual and Augmented reality, etc.)

General AI (AGI)

This is a theoretical type of AI that can understand, learn, and apply intelligence across a wide range of tasks, just like how humans do. It would be capable of reasoning, problem-solving, and understanding context in ways that allow it to handle any cognitive task, not just those it was specifically trained for. AGI would also have the ability to transfer knowledge learned in one area to another, a feature we, human beings possess however is lacking in today’s narrow AI. At that level, life is mimicked and truly virtualized to the point that it would be near impossible to distinguish the differences between Living and Virtual, and machines could essentially have emotions, self-realization, and the ability to self-reproduce. There are no examples of General AI except in Hollywood’s science fiction (Wikipedia contributors, n.d.) However, AI researchers believe that few, but key characteristics could include:

- the ability to seek learning from data generated by other AI systems, and adapt quickly to new, unseen tasks, much like humans do.

- the ability to reason abstractly, simulate different scenarios, and generate truly novel ideas.

- AGI could transfer knowledge across various domains (e.g., using knowledge from playing chess to improve performance in another task, like driving a car).

- Self-realization, emotions, anger and fear, happiness and sadness. Again, these have been postulated and represented in Science Fiction (Wikipedia contributors, n.d.)

AI applications are a web of complex and interdisciplinary fields that includes Biology Computer Science, Neuroscience, Philosophy, Law, Ethics, Medicine, Finance, and Psychology along with many engineering disciplines such as electrical and mechanical engineering. A heavy area of Narrow AI research is focused on understanding the foundation of Human Intelligence in hope of replicating it in machines.

What is Intelligence?

James R. Flynn, arguably the most prominent researcher in the field of “intelligence” defines the term as “the ability to learn from minimal data and adapt quickly to new, unseen tasks. Much like humans do. It would also include having the ability to reason abstractly, simulate different scenarios, and generate novel ideas”) by this very definition, intelligence therefore, must be coupled with the word behavior. Hence, intelligent machine behavior is modeled after intelligent human behavior that has very specific characteristics:

- Learn from past experience – Situations and events drive human behavior. As toddlers, we quickly learn not to touch hot objects but only after we’ve experienced pain effects and through the trial-and-error method.

- Correctly handling complex and sometimes competing situations. An ability of successful managers depends on knowing how to balance the needs of the organization vs. the need of the individual employees.

- Solving problems often with little or missing information. How do we deal with uncertainty?

- Prioritization – Determine what is important and how to, preverbally, juggle running chain saws and watermelons simultaneously

- Being nimble and react appropriately to a new situation – Swerving away from an oncoming car is brain and muscle memory working together. Computers can react and swerve much faster than a human can.

- Understand Visual Clues and Symbols – Easy for students to walk into any classroom and know what a desk is, what a board is, and where the teacher stands. Easy for us walking through the maze of other students, desks, and tables without hurting oneself. Not so easy for a computer. However, perceptive systems have been successfully developed to overcome these challenges.

- Process images, sounds, smells, touch and tactile sensations. Computers can hear, listen and understand and can see and process images, can also smell (better than a human, but much less than a dog). They can also taste and feel hot or cold or any range of temperatures in-between.

- Creative and Imaginative –using generative AI one can develop what could be considered as very creative and very imaginative art, music, literature and poetry, but is it original work? This has been an endless debate over the last couple of years.

Generative AI Overview

Generative AI, such as ChatGPT models focuses on creating new content, such as text, images, and music, by learning patterns from existing data. Unlike traditional expert systems, generative AI excels in handling unstructured data and adapting to new information, however, it often lacks the inherent explain-ability of expert systems, creating challenges in accountability and trust.

List of Current Generative AI Types and Their Uses

There are several generative AI models each with its own set of algorithms to use in processing the “generation and regeneration” of information (Dugal, 2025). The 2025 list contains:

|

Brand |

Best for |

|---|---|

|

ChatGPT

|

This very textbook has about 20% ChatGPT content. |

|

AlphaCode

|

Software development specifically to train other AI models |

|

GitHub Copilot

|

Authoring software programs |

|

Gemini (Previously Bard)

|

User Rating – chatbot and content generation tool developed by Google. |

|

Cohere Generate

|

Custom content emails, website landing pages, and social media product marketing |

|

Claude

|

Assistant – Research has focused on training AI and is still in research phase. Trains other AI systems to be helpful, fair, and safe to use. |

|

DALL-E2

|

Image and art generation with photo quality realism |

|

Synthesia |

Creating high quality video content |

|

Copy.AI |

Creative writing, marketing slogans, and news headlines, |

|

Rephrase.ai |

Digital Avatars to be used in Videos |

|

Descript |

Video publishing, full multitrack editing, transcription, and screen recording. |

|

SoundDraw |

Music generation |

Table: List of AI models and their frequent uses

Uses of Generative AI in Various Economic Sectors

Generative AI had experienced explosive growth. It has found its way into countless economic sectors. Mainly:

Healthcare:

Generative AI models integrated with expert system rules are used to generate personalized treatment plans, simulate disease progression, and enhance diagnostic tools.

Example: AI tools generating patient-specific recommendations based on both expert-defined rules and learned patterns from medical databases.

Finance:

Hybrid systems are employed to generate investment strategies, identify fraud, and predict market trends.

Example: AI-driven financial advisors combining historical market data with regulatory compliance rules from expert systems.

Creative Industries:

Generative AI produces high-quality content such as music, art, and literature, with expert systems ensuring adherence to stylistic or domain-specific constraints.

Example: Music composition tools using rules from expert systems to replicate the style of classical composers.

Education:

AI systems create adaptive learning materials and simulations tailored to individual student needs, with expert systems guiding pedagogical principles.

Example: AI tutors that design curriculum pathways by blending expert rules with generative capabilities.

Hospitality:

Artificial Intelligence is transforming the hospitality industry in multiple ways by enhancing customer experiences, streamlining operations, and driving revenue growth. Example areas impacted by AI include:

Personalized Customer Experiences – AI analyzes guest preferences and past behaviors to personalize experiences, recommendations, and interactions.

Revenue Management and Pricing Optimization – AI predicts demand fluctuations, helping hotels dynamically price rooms and services to maximize revenue.

Operational Efficiency and Automation – AI automates repetitive administrative tasks like check-ins/check-outs, booking management, and guest communications.

Challenges and Concerns With Generative AI

Despite their promise, there are many challenges and considerations in integrating expert systems into generative AI. The main critique of generative AI include:

Bias (degree of errors): Ensuring equity and fairness requires careful curation of the knowledge base and the training data.

Complexity: Designing hybrid systems requires balancing rule-based reasoning with the flexibility of generative models.

Scalability: Maintaining and updating the knowledge base of expert systems is human and machine resource intensive.

Machine Learning

The Origin of Machine Learning

Machine learning (ML) is a branch of artificial intelligence (AI) that enables systems to learn from data and improve their performance without being explicitly programmed. The origins of machine learning trace back to the mid-20th century, when researchers began to explore the idea of creating machines that could simulate human learning processes. The foundational concept was inspired by Alan Turing, who introduced the notion of a “learning machine” in his seminal 1950 paper, Computing Machinery and Intelligence (Turing, 1950). Turing hypothesized that machines could improve their behavior through experience.

In 1959, Arthur Samuel further advanced the concept by developing programs that could play checkers, pioneering the term “machine learning”. Samuel’s work demonstrated that machines could be trained to optimize their performance through iterative improvements based on data analysis. Since then, ML has grown exponentially, driven by advances in computational power, the availability of large datasets, and the development of sophisticated algorithms.

How Are Machines Trained?

Machines are trained using large datasets that serve as inputs to algorithms. The training process involves:

Data Collection: Gathering a comprehensive and relevant dataset.

Data Preprocessing: Cleaning and formatting the data to ensure it is suitable for training.

Algorithm Selection: Choosing an appropriate algorithm based on the problem type.

Model Training: Feeding the data into the algorithm to identify patterns and learn decision rules.

Evaluation: Assessing the model’s performance on unseen data to ensure it generalizes well.

Optimization: Fine-tuning the model to improve accuracy and efficiency.

The Four Training Modes in Machine Learning

Machine learning uses 4 different modes of training:

1. Supervised Learning

In supervised learning, the model is trained on a labeled dataset (a set of data that has been classified) where the input data is paired with the correct output. It works by learning a mapping function from inputs to outputs by minimizing the path error between a predicted and an actual output(s). Supervised Learning uses applications that classify (i.e., sort and group) tasks for a desired problem output. (e.g., email spam detection) and regression tasks (e.g., predicting housing prices).

2. Unsupervised Learning

In unsupervised learning, the model is trained on an unlabeled dataset, meaning it must find hidden patterns or structures in the data without the data being organized. It works by applying algorithms the perform functions such as:

- Clustering which is a grouping of similar things together based on their features, without anyone telling the computer what the groups should be. For example, all cars are clustered into one group, all airplanes into another group. Clustering would be a result (output) rather than a preemptive input as in Supervised learning. In Fintech, clustering can be applied to classify customers by shopping behavior and banks by lowest percentage rate they charge for processing a transaction. These characteristics are found, and remembered (i.e., stored) by the algorithm.

- Dimensionality reduction is used to identify groupings through data representations. Dimensionality is about how many features or characteristics a dataset has. For example, imagine you are describing a car that has:

- One feature (1 dimension): The car’s color.

- Two features (2 dimensions): The car’s color and speed.

- Three features (3 dimensions): The car’s color, speed, and weight.

Datasets in the Financial industry are highly complex and have many features. For example, when Banks, or Insurance companies analyze a loan request, or a policy, to determine their risk exposure, their AI system would analyze the customer’s request based on dozens of dimensions such as age, income, employment, credit score, and spending habits, amongst many others. Dimensionality algorithms can call up data accumulated from many of data sources to refine its output. In our example of applying for credit, the algorithm will send requests to review a credit report, callup transactional databases that contain transaction details such as what items the customer spends money on, callup tax records to verify income, etc.

3. Reinforcement Learning

Reinforcement training uses an AI agent (a software computer program), that is asked to solve an optimal route (solution) using a reward-penalty system. It is a system based on trial-and-error. For example, driving for delivery company, your daily route as designed by the AI system is to travel daily dropping off 50 packages at 50 different locations around the city. In preparation for a daily run, the AI system will solve for an optimal route that saves on time, fuel, vehicle maintenance, reduce probability of getting into an accident, and guarantees on time delivery. The system will be trained to classify all these variables into dimensions, assigning +weights (for rewards) and -weights for (penalties) for each pass through the layers leading to a solution. With each pass, the system “learns” which of the nodes has a greater chance of receiving a reward. Again, through iterative training sessions, the system will develop a solution that will be considered an “optimized delivery” model that can be used for that specific day’s deliveries.

4. Semi-Supervised Learning

Semi-supervised machine learning is a type of learning that uses both labeled and unlabeled data to train a model. It’s like teaching someone a new topic by giving them a few clear examples (labeled data) and then letting them figure out the rest by exploring on their own (unlabeled data). Example of labeled data is a set of pictures with a label stating, “farm animals” with pictures showing Horses, Cows, Chicken, Etc. while unlabeled data would be the same set of pictures, with a possible inclusion of a tractor, a harvester, pitchfork and a grain silo. In the second set of pictures, there will not be a label mentioning what the pictures are, or what is in them.

In Fintech, the use of semi-supervised learning is key due to its economies. There is no need to identify each transaction as fraudulent or not fraudulent. Just few fraudulent examples would suffice for the system to determine common characteristics such as the profile for transactions originating outside of normal locations, number of transactions matching those that are fraudulent, or transactions that started by a known fraudulent merchant or user.

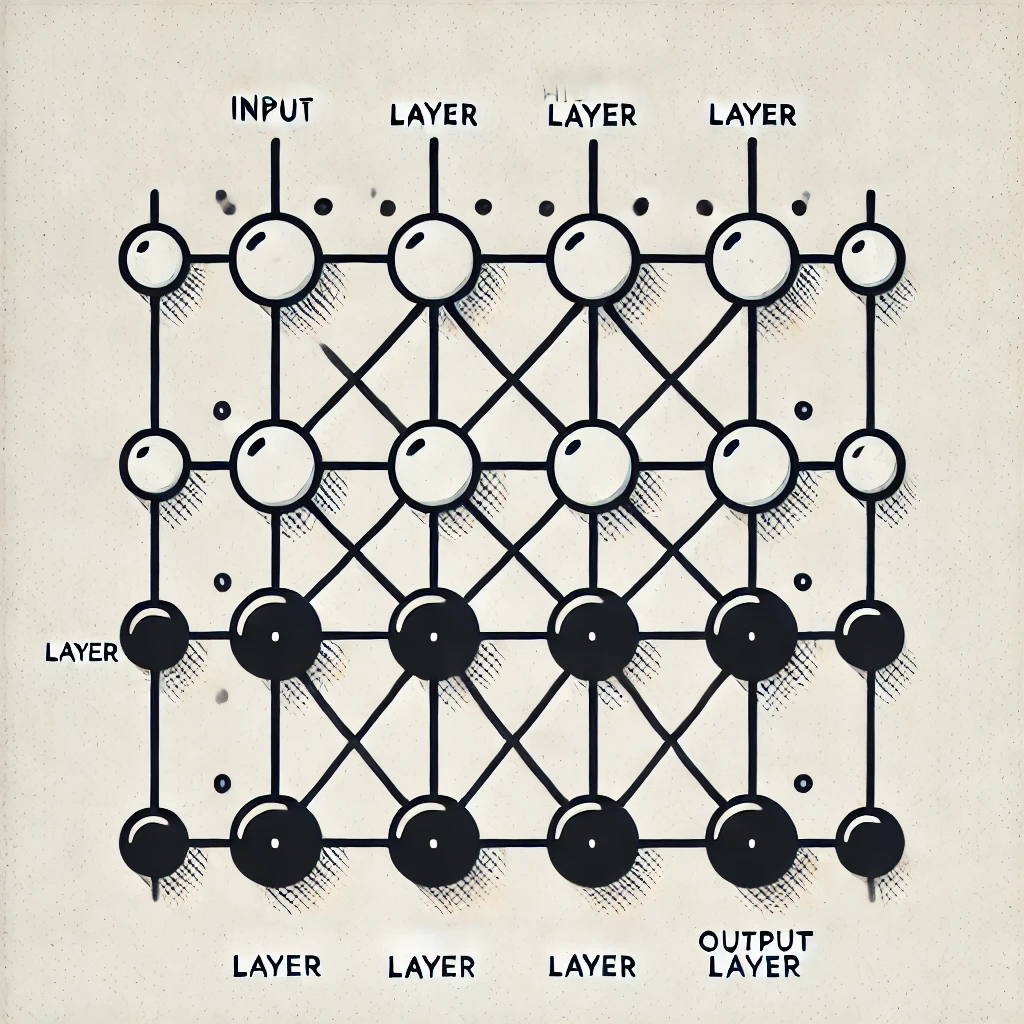

Neural Networks and Deep Learning in AI

Neural networks are a type of machine learning model inspired by the structure and function of the human brain. They consist of layers of interconnected nodes (neurons) that process data by assigning weights and biases (importance and degree of error), enabling the network to learn patterns and relationships in data. Neural networks are used for tasks like classification, regression, image recognition, natural language processing, and more.

How do Neural Networks work?

Just like the human brain’s composition of layers of biological neurons, Machine Learning using neural networks, which also has many layers that we call deep neural networks. These network layers mimic the human brain’s structure and function, allowing them to process large and complex datasets. Deep learning excels at feature extraction, automatically identifying the most relevant features in the data without manual intervention. The inner processes that uses neural networks include:

- Data Classification Process – At the input layer, neural networks classify the data into predefined categories or labels. An example would be feeding an email script which the classification layer processes to categorize it as spam or not spam, hate email or NOT hate email, and so on.

- Regression Process – Regression involves predicting continuous numerical values rather than discrete categories. An example would be predicting new home prices based on features like size, location, and age.

- Clustering Process – Neural networks can group data into clusters based on similarity, even without labeled training data. An example could be segmenting customers into groups based on purchasing behavior, or groupings of 1st year college students by a target area of study (e.g., how much they spend on Coffee Lattes)

- Dimensionality Reduction Process – Neural networks, can reduce the number of features in a dataset while retaining critical information. An example could be compressing high-dimensional image data – such as an image of the sky behind the subject in the image, into a smaller feature set.

- Generative Tasks Process – Neural networks can generate new data very much similar to the input data they were trained on. It is the essence of what most AI models produce currently. An example would be the ability of AI to correctly postulate and produce coherent answers to questions on themes such as for generating stories, poetry, or dialogue where the user asks the AI model to “write a short story about a robot discovering emotions.” In this example, the Language Model would have been trained on language usage, writing styles, fiction as a theme, science fiction as an epilog, Robots as smart machines, and many others.

- Sequence Prediction Process – Neural networks can analyze sequential data and predict the next elements in the sequence. Examples include Text generation such as for auto-complete or predicting stock prices over similar periods of time.

- Object Detection Process – Detecting and localizing multiple objects within an image, assigning a bounding box and determining a class label to each object. Such as man walking a dog, female with a shopping bag, homeless person pushing a shopping cart, etc. Example uses would include detecting vehicles, pedestrians, center lanes, and traffic signs in self-driving cars.

- Semantic Segmentation Process – Is classifying each pixel of an image into a category, effectively partitioning the image into meaningful segments. Example uses would include identifying roads, buildings, and vegetation in satellite imagery.

- Anomaly Detection Process – Identifying unusual patterns or outliers in data. Example uses would include detecting fraudulent transactions in financial datasets.

- Recommendation Process – Predicting user preferences and suggesting items based on historical data such as suggesting movies on Netflix or products on Amazon.

- Image-to-Image Conversion Process – Converting images from one format to another using neural networks. Image-to-image processing is used for:

Super-resolution: Enhancing image resolution.

Style transfer: Applying artistic styles to images.

Image colorization: Adding color to grayscale images.

- Speech and Audio Processing – Handling tasks related to sound and speech. Example uses include:

Speech recognition: Transcribing spoken words into text.

Speech synthesis: Generating human-like speech (e.g., text-to-speech systems).

- Time Series Analysis Process – Is a statistical-based analysis and prediction model that processes patterns in time-series data (data that is time stamped in linear time sequences). Time series is important for applications requiring super large data sets such as predicting weather, machine breakdowns, or the most likely item that a customer may purchase next.

- Multi-task Learning Process- Training a single neural network to perform multiple related tasks simultaneously. Example usage is for a model that can recognize an image, and simultaneously detect objects within it.

Applying AI and Machine Learning in FinTech

Machine learning is transforming classical applications of the financial industry into the modern FinTech sector by replacing legacy business approaches, enhancing operational efficiency, reducing costs, improving accuracy, and increasing security. Below are some common applications:

Fraud and Anti-Money Laundering Detection

ML models analyze transaction data in real time to identify anomalous patterns indicative of fraudulent activity. Deep learning models can detect subtle irregularities in transaction metadata. For example, someone shops at 5 different stores on the same day, using a different credit card on each transaction and withdraws cash with each transaction.

Credit Scoring

ML algorithms evaluate creditworthiness by analyzing financial behavior, payment history, and alternative data sources. This enables institutions to offer credit to underserved populations.

Algorithmic Trading

Reinforcement learning models optimize trading strategies by learning market dynamics and adapting to changing conditions. Algorithms process vast datasets to predict price movements and execute trades efficiently.

Customer Personalization

FinTech platforms use supervised and unsupervised learning to offer personalized financial products, such as tailored investment portfolios or savings plans.

Risk Management

Predictive analytics models assess risks associated with loans, investments, or insurance policies, improving decision-making.

Machine learning continues to revolutionize industries, with FinTech at the forefront of its adoption. The synergy between deep learning techniques and FinTech applications promises greater financial inclusion, enhanced security, and personalized services, driving innovation in the global economy.

AI and Robotics

Labor is defined as a physical, or mental human effort applied against objects to transform them. Labor throughout history has gone through many evolutionary phases. Initially human labor was focused on what nature provided (the age of hunter-gatherer), then through mechanization (e.g., making tools to ease the labor process), then followed by mechanization (using power to drive tools such as tractors and harvesting machines) and on to automation that programmed machinery to repetitively produce objects in mass quantities (machines that automate production) and on to AI-supported systems and methods of production such as in farming using smart autonomous machinery (e.g., smart efficient farming to produce more with less resources such as labor, land, chemicals, water, etc.)

Labor in Fintech traditionally required complex business processes that went through the same evolutionary path as was discussed previously in this textbook. The latest evolution in Fintech is applying AI in ways that envision the future. “We need banking, but we don’t need banks anymore” Bill Gates stated in 1997 envisioning the future (American Deposits. n.d.).

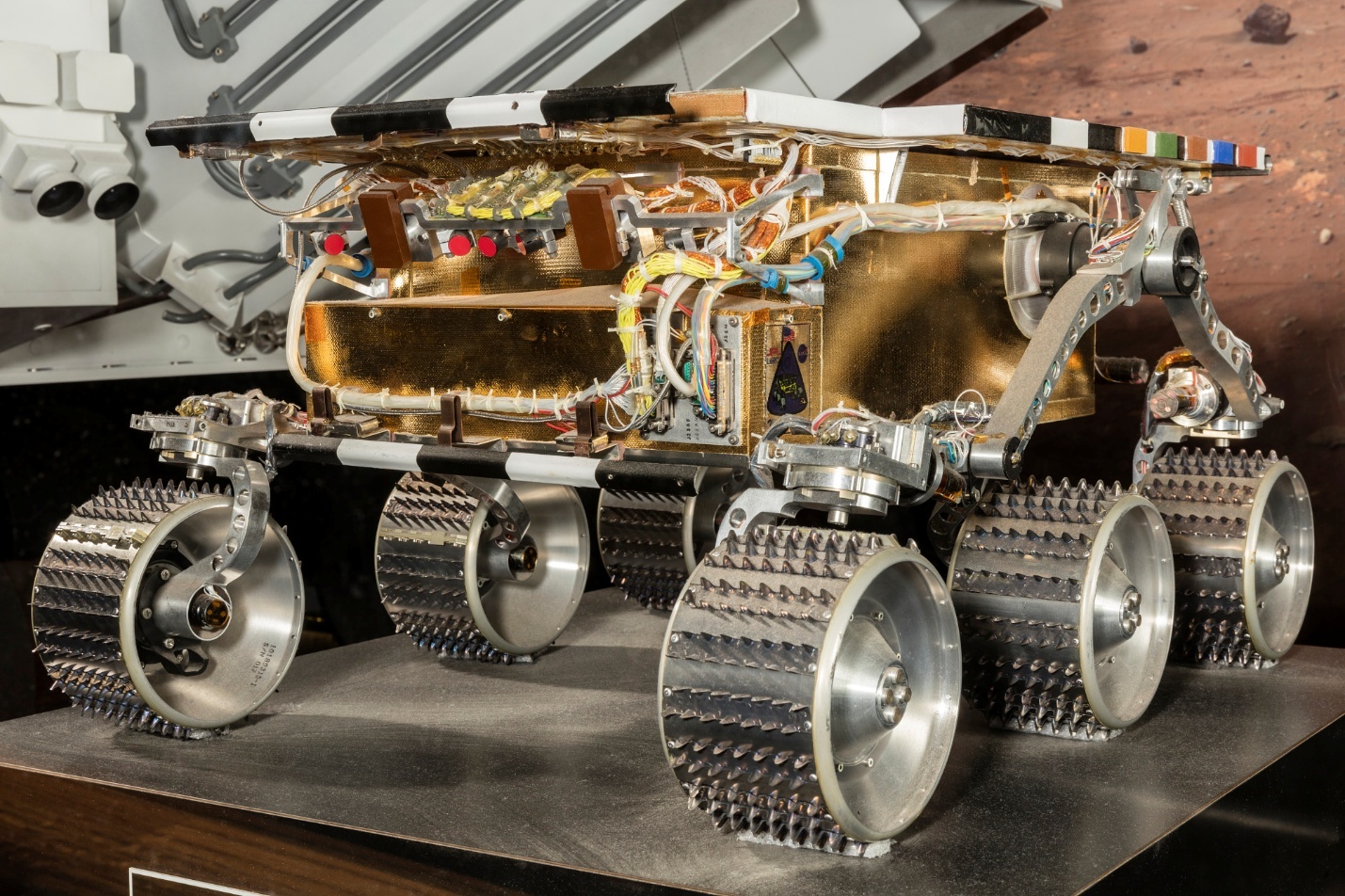

Early Robots were machines that replicated certain human movements. Starting in the early 1960’s heavy industries began using Robotic machines to perform highly repetitive tasks (boring things that drive people mad, such as counting things), or tasks that required dangerous, tedious, and exact such as lifting heavy items, handling, fabricating and inspections in radioactive environments. These evolved into much more complex Robots performing activities such as exploring the depth of oceans and explorations of deep space and the surfaces of the Moon and Mars.

This course is not about hardware Robots or the study of Robotics. We mentioned them as a prologue to introducing the subject of Software type of Robotics known as Robotic Process Automation.

Robotic Process Automation: Transforming the Fintech Industry

Robotic Process Automation (RPA) refers to the use of software robots or “bots” to automate repetitive, rule-based tasks that were traditionally performed by humans. These bots interact with digital systems and software in the same way a human would, but with greater speed, accuracy, and consistency. Unlike traditional automation, RPA does not require extensive programming or changes to existing IT infrastructure, making it a highly accessible and scalable solution for organizations.

RPA leverages technologies such as artificial intelligence (AI), machine learning (ML), and natural language processing (NLP) to handle tasks such as data entry, transaction processing, and customer service interactions. By automating these processes, businesses can improve efficiency, reduce operational costs, and free up human employees to focus on more strategic and creative tasks.

RPA Components

Building an RPA system involves designing “software bots” and setting up the necessary software to perform specific tasks. To develop a functioning RPA, the requirements would include:

Understanding the Process: First, a business identifies tasks that are repetitive, rule-based, and time-consuming. These tasks are perfect candidates for automation.

Choosing the RPA Software: Next, a company picks an RPA tool, like UiPath, Blue Prism, or Automation Anywhere. These tools provide a platform to design and deploy bots.

Designing the Bot: Using the RPA tool, developers or analysts create a “workflow,” which is a step-by-step script that tells the bot what to do. For example, “open this file, copy data from column A, and paste it into another system.”

Testing: The bot is tested to ensure it performs the task correctly and efficiently.

Deployment: Once tested, the bot is deployed in the company’s systems to work alongside humans or on its own.

Main Components of RPA

Bot Designer: This is where the bot is built and programmed. It uses a visual interface to map out tasks step by step.

Bot Runner: This is the environment where the bot actually performs its tasks. It executes the instructions created in the designer.

Control Room: This is the central hub for managing and monitoring all bots. It helps track performance and ensure bots are functioning correctly.

RPA systems also rely on integrations with existing software, allowing bots to work across multiple applications without requiring major changes to those systems.

Applications of RPA

RPA is used across a variety of industries and functions to optimize operations and enhance productivity. Some common applications include:

Data Entry and Migration

Many newer systems are made with newer approaches including programming languages requiring the migration of older systems data to newer ones. RPA helps in automating the transfer of data between systems without human intervention.

Invoice Processing: Extracting data from invoices, validating information, and processing payments. The traditional approach is for a human analyst to run jobs inside of computer systems to extract data, validate information such as customer name and address in preparation for shipping. RPA automates this and many other processes such as matching Invoice numbers to specific Customer accounts, automatically looking up inventory and issuing an order to pull from inventory, and prepare all shipping and receiving paperwork. Upon completion, the RPA may connect to the financial system to reconcile the account eliminating to a great degree functions that are manually performed by company staff.

Customer Support: We are all familiar with chatbots especially around customer support. A chat bot is a form of an RPA that is programmed to understand human (customer) voice or typed interactions. It can listen and record a call and even attempt to resolve an issue. Chatbots can also email, or call specialists within the company to come on-line to assist the customer.

Compliance and Auditing: RPA bots are sometimes used to ensure regulatory compliance by automating the generation of audit trails and reports. Depending on the nature of the business, government regulatory bodies, like in Telecommunication and energy for example could require a company to generate periodic reports that are excessive. RPA have been deployed in these industries to collect regulatory specific information, ensure its accuracy, then format it into the required style the government requires and ensure such reports are delivered at the proper times.

IT Support: Automating routine IT tasks like password resets and software installations.

RPA Applications in the Financial Industry

The financial industry has been a significant beneficiary of RPA, using it to streamline operations, improve customer experiences, and ensure compliance. Examples where Financial institutions rely on RPA include:

Transaction Processing: Automating routine tasks such as account reconciliations, payments processing, and loan approvals.

Fraud Detection: Using bots to monitor transactions for anomalies, flagging potentially fraudulent activities in real time.

Regulatory Compliance: Automating the creation and submission of compliance reports to meet stringent regulatory requirements.

Customer Onboarding: Simplifying the customer onboarding process by automating the collection and validation of customer data.

Risk Management: Automating the aggregation and analysis of risk-related data to support decision-making.

Case Study: AI-Driven Digital Transformation in Healthcare – A Fintech Perspective

Background

In April 2024, Chi Mei Medical Center in Taiwan introduced generative AI copilots built on Microsoft’s Azure OpenAI Service. This deployment represents a key example of how fintech principles—automation, data integration, and real-time analytics—can transform traditional sectors like healthcare by addressing workforce shortages, improving operational efficiency, and enhancing service quality.

Chi Mei Medical Center operates within Taiwan’s renowned healthcare system, which faces significant challenges due to an aging population, a low birth rate, and increasing demand for medical services. By leveraging AI tools tailored to specific medical workflows, Chi Mei aims to alleviate healthcare worker burnout while maintaining high standards of care.

AI Copilots in Action

Chi Mei’s AI copilots were designed for various roles:

- A+ Pharmacy Copilot: Helps pharmacists retrieve and summarize patient data, flagging potential drug interactions and insurance coverage.

- A+ Doctor Copilot: Streamlines medical report generation, reducing documentation time from one hour to 15 minutes.

- A+ Nurse Copilot: Speeds up the process of documenting patient transfers and shift changes.

- A+ Nutritionist Copilot: Offers dietary recommendations based on patients’ medical conditions.

By integrating data from multiple databases, these copilots provide comprehensive patient profiles, enabling healthcare providers to focus more on patient care rather than administrative tasks. In May 2024 alone, these AI copilots were used over 36,000 times by 3,500 individual users across the hospital’s departments.

Impact on Healthcare Efficiency

The introduction of AI copilots has delivered measurable benefits, including:

- Increased Patient Capacity: Pharmacists doubled the number of patients they can serve daily, from 15 to 30.

- Reduced Burnout: Early surveys indicate a drop in burnout scores among nurses.

- Improved Workflow: Nurses report a reduction in documentation time from 20 minutes to under five minutes per task.

Despite initial resistance from healthcare professionals who feared AI might replace them, hospital administrators emphasized that AI tools are intended to assist staff, allowing them to leave work on time and spend more quality time with their families.

Challenges and Finetuning

While the copilots have performed well overall, some areas for improvement remain:

- Language Accuracy: Occasional use of simplified Chinese characters instead of traditional script requires manual correction.

- Professional Terminology: The copilots sometimes use layperson terms instead of precise medical language, necessitating edits during reviews.

- Perceived AI Authorship: Some users felt that the generated reports were too formulaic, making them appear AI-authored.

Chi Mei’s ongoing efforts include improving language models and expanding copilot functions, such as a forthcoming A+ National Exam Review Copilot for medical professionals’ continuous education.

Conclusion: A Fintech Model for Healthcare Innovation

This case study illustrates how fintech innovations can be adapted to healthcare, demonstrating the potential of AI-driven solutions in enhancing efficiency, accuracy, and user satisfaction. By integrating fintech principles—such as real-time data analysis, automation, and user-centric design—Chi Mei Medical Center has become a leader in digital healthcare transformation.

Through continuous refinement of AI tools and active collaboration with healthcare providers, Chi Mei exemplifies how fintech-inspired technologies can address critical challenges in other sectors, paving the way for broader adoption across industries (Yee, 2024).

Feedback/Errata